e-invoices

Over View of E-Invoicing

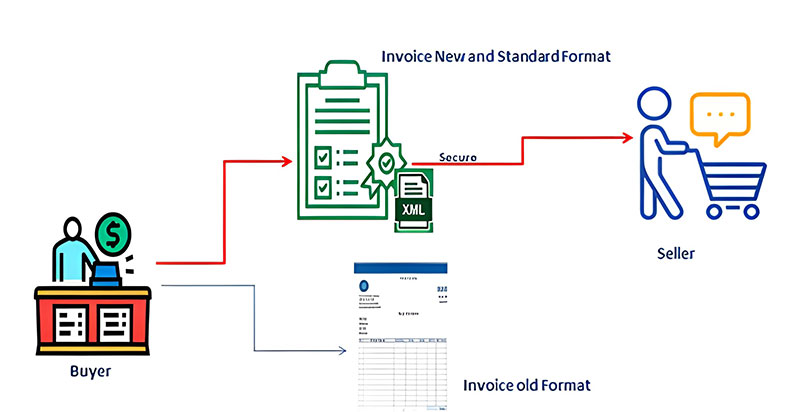

An E-Invoice is a digital representation of a transaction between a supplier and a buyer. E-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes. E-invoicing, is a form of billing that is presented to the buyer in an electronic format via a predefined structured data exchange. This electronic document exchange between buyer and seller can help streamline and automate portions of the accounts payable process.

An E-Invoice is a file created in the format specified by IRBM that can be automatically processed by relevant systems.

To support the growth of the digital economy, the Government shall implement e-Invoice in stages, in an effort to enhance the efficiency of Malaysia’s tax administration management.

Below are E-invoice formats:

The format of E-invoice is not a:

An E-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

The e-Invoice model adopted by the Government ensures a comprehensive and standardized approach to the generation, transmission and recordkeeping of transaction documents. The Government is cognisant that in order for the implementation to be successful, it is important that this should result in minimal disruption to business processes and flow.

The principle of e-Invoicing implementation requiring e-Invoice to be issued would be as follows:

a) Proof of income: This document is issued whenever a sale or other transaction is made to recognize income of taxpayers;

b) Proof of expense: This type of document covers purchases made or other spending by taxpayers and includes returns and discounts. It can also be used to correct or subtract an income receipt in terms of the amounts documented. As the issuance of e-Invoice is the responsibility of the supplier, as a buyer, the taxpayer would need to ensure it has the necessary e-Invoices to prove its expense/spending.

In addition, there are certain circumstances where taxpayers would have to issue a self-billed e-Invoice to document an expense where the supplier is not mandated to issue e-Invoice such as foreign transactions.

key regulations for e-invoicing in Malaysia:

Malaysia’s e-invoicing system aims to streamline and digitize the invoicing process for businesses in the country, ultimately improving the efficiency of Malaysia’s tax system and having a positive impact on the economy. By adopting electronic invoicing, businesses can enjoy benefits such as increased efficiency, reduced costs, improved accuracy, and faster payment cycles.

The key features and requirements of the e-invoicing system include the use of QR codes, compliance with specific formats like XML or PDF, integration with the MyTax portal, and seamless integration with the integrated tax return filing system.

This initiative, known as the National E-Invoicing Initiative, aims to increase business efficiency by eliminating manual data entry and physical paper handling processes. Especially when it is going to be joining the PEPPOL network later on, and that’s 1 big step to join the global digitalization movement.

To implement e-invoicing in Malaysia, businesses need to register with the government, adhere to the regulations set by the tax authorities, and ensure their invoices are verified by the Malaysian Inland Revenue Board (IRB). While there are challenges and key considerations in adopting e-invoicing, including changes in accounts payable functions, following best practices can lead to successful pilot implementation and compliance with the regulations.

The Malaysian Inland Revenue Board (IRB) provides further guidance on the mandatory e-invoice implementation, which includes updated guidelines on the gradual roll-out for targeted taxpayers.