e-invoices

Types of e-invoices

in Malaysia?

In Malaysia, the e-invoice mandate covers the below document types:

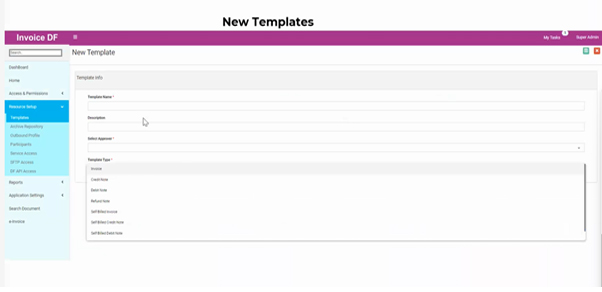

- Invoice

- Credit note

- Debit note

- Refund invoice

- Self-billed invoice

The below documents must be issued in electronic format under Malaysia e-Invoice:

Invoices: It is generally used to record transactions between supplier and buyer. Invoices also include a self-billed invoice issued for tracking expenses.

Credit notes: A credit note is a document issued by sellers to make corrections to an e-Invoice issued previously mainly to lower the original invoice's value without returning money to the Buyer. It is generally used to adjust errors, apply discounts, or account for returned items.

Debit notes: In contrast to credit notes, debit notes are issued to record additional costs related to a previously issued e-Invoice.

Refund notes: A refund e-Invoice is an official document issued by a Seller to record refund issued to the Buyer.

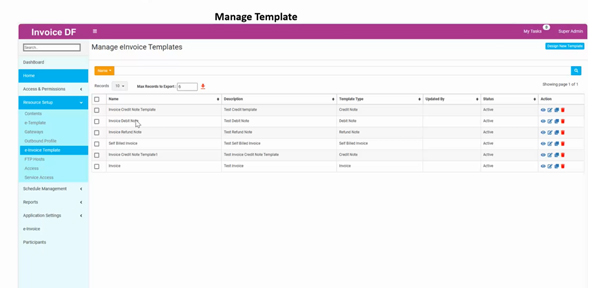

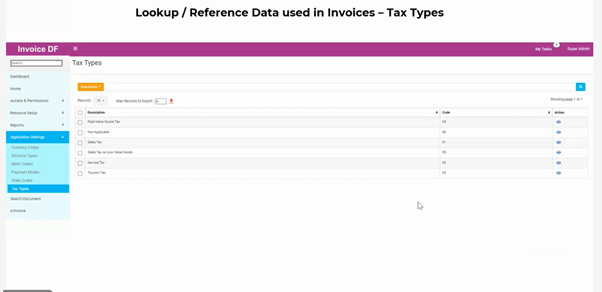

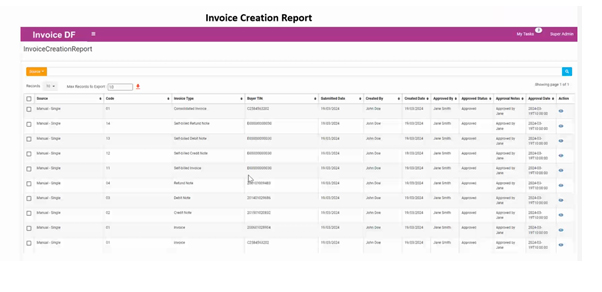

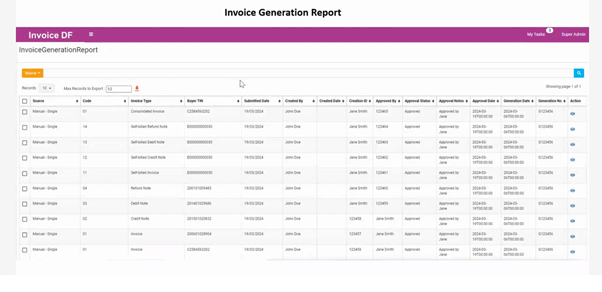

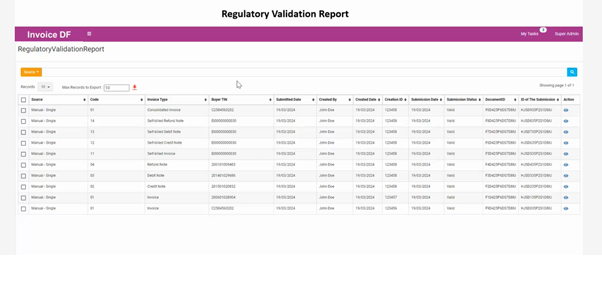

List of e-Invoice types allowed as part of the document submission.

| Code | Description |

|---|---|

| 01 | Invoice |

| 02 | Credit Note |

| 03 | Debit Note |

| 04 | Refund Note |

| 11 | Self-Billed Invoice |

| 12 | Self-Billed Credit Note |

| 13 | Self-Billed Debit Note |

| 14 | Self-Billed Refund Note |